What Questions Are Asked for Health Insurance?

What questions are asked for health insurance? Choosing health insurance doesn't have to be overwhelming if you know what questions are asked for health insurance. These key inquiries help you find coverage that fits your needs, budget, and lifestyle without surprises. Start by evaluating your situation with these essential questions.

Who Needs Coverage?

One of the first what questions are asked for health insurance is who your plan will cover. Consider yourself, a partner, children, or dependents, and their expected medical needs like routine checkups or chronic conditions.

If you're young and healthy, a high-deductible plan might work for solo coverage. For families, prioritize broader protection. List everyone involved to guide your choice.

Preferred Providers In-Network?

What questions are asked for health insurance often include checking your favorite doctors, clinics, or hospitals. Verify they're in the plan's network to avoid higher out-of-pocket costs for out-of-network care.

Use the insurer's online directory or call customer service. Staying in-network keeps copays low and predictable. For details, explore networks on HealthCare.gov.

Covered Services Match Needs?

A top question among what questions are asked for health insurance is whether the plan covers your specific care. Review the list of covered services for prescriptions, chronic condition treatments, behavioral health, or surgeries.

Plans vary—some fully cover preventive care, others limit specialties. Match this to your family's anticipated expenses for the year.

Affordable Out-of-Pocket Costs?

Budget fits into what questions are asked for health insurance by examining premiums, deductibles, copays, and coinsurance. High premiums often mean lower deductibles, ideal if you expect frequent use.

Assess what you can afford if unexpected care arises. Compare total costs: a low-premium plan might lead to high deductibles. Companies like New Perspective Healthcare help crunch numbers.

HMO or PPO Flexibility?

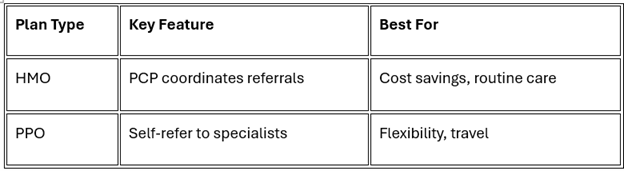

What questions are asked for health insurance frequently cover plan types like HMO vs. PPO. HMOs require a primary care provider (PCP) for referrals, offering lower costs but less flexibility.

PPOs allow self-referrals to specialists with broader networks, though premiums are higher. Choose based on your need for freedom in care.

HMO and PPO features and comparison.

For personalized advice on what questions are asked for health insurance, visit New Perspective Healthcare. Connect via their contact page to review options tailored to you.