What Are Copayments in Health Insurance?

Many people ask, “What are copayments in health insurance?”. Navigating health insurance can feel overwhelming, especially with terms like copays, deductibles, and premiums. If you're wondering what copayments in health insurance are, you're not alone—many people struggle with these basics. Copayments, or copays, are a key part of sharing costs with your insurer.

Defining Copayments Clearly

What are copayments in health insurance? A copayment is a fixed dollar amount you pay for covered services, like a doctor's visit or prescription, usually at the time of service. For instance, you might pay $20 for a primary care appointment or $10 for a generic drug. These amounts vary by plan and service type but help keep your costs predictable.

Copays typically apply after you've met your deductible, though some plans waive them for certain services. Unlike coinsurance, which is a percentage, copays stay flat regardless of the total bill. Check your plan details on HealthCare.gov for specifics.

Copays vs. Other Costs

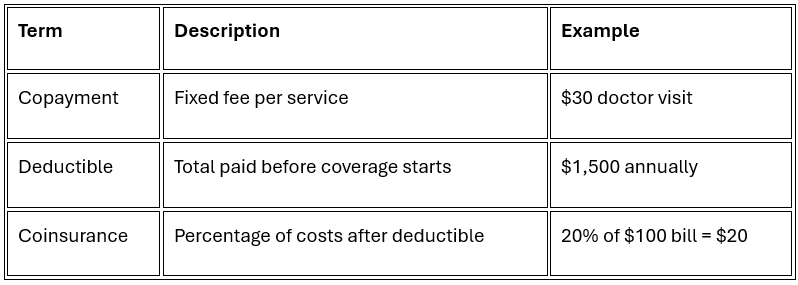

Understanding copayments in health insurance means comparing them to deductibles and coinsurance. A deductible is the amount you pay out-of-pocket before insurance kicks in fully, while coinsurance splits the bill as a percentage after that (e.g., 20% of costs).

Table describing the terms “Copayment”, “Deductible”, and “Coinsurance”.

Premiums are monthly payments to keep coverage active, often split with employers in ESI plans. For more on premiums, see KFF's guide.

Copays in Employer-Sponsored Insurance

Employer-sponsored insurance (ESI) covers over half of Americans and uses copays widely. In ESI, you might pay a $15 copay for in-network visits, lower than out-of-network rates. Networks include contracted providers for cheaper care—always verify yours.

Out-of-pocket maximums cap your total costs (excluding premiums), including copays. Once reached, insurance covers 100%. Explore ESI trends on SHADAC's site.

Examples in Real Plans

Imagine two scenarios with what are copayments in health insurance in action. In a traditional plan: $150 monthly premium, $1,000 deductible, $45 copays. Low use? Total ~$1,890 yearly. High-deductible plan (HDHP): $0 premium, $4,000 deductible, no copays until met—better for healthy folks at ~$600 low use.

HDHPs pair with HSAs for tax-free savings on copays and more. Learn about HSAs at CMS.

Tips for Managing Copays

To handle what are copayments in health insurance, review your Summary of Benefits annually. Use in-network providers and navigators for help—find yours via HealthInsurance.org. Track costs with apps or portals to avoid surprises.

Prior authorizations may apply for some services, ensuring coverage. Boosting health insurance literacy saves money long-term.

For personalized guidance on navigating copays and finding the right health plan, visit New Perspective Healthcare. Reach out via their contact page to review your coverage for free—they specialize in simplifying options to fit your needs.